People Clerk helps you with your small claims court lawsuit.

Get StartedContents

If you are suing someone in California small claims and you are low-income, you may be able to ask the court to waive your filing fees and sheriff serving costs. To submit a request to the court to waive your fees, you will need to prepare and file a court fee waiver form called FW-001 “Request to Waive Court Fees.” In this article, we cover how to qualify for a fee waiver, how to complete the FW-001 Waiver, and what we have learned by helping individuals prepare the request to waive court fees.

Need California small claims assistance? People Clerk can help.

When Should You Ask for a Waiver?

The best time to request a waiver of your court fees is at the moment you file your small claims case. This is because once the case is filed, the hearing date will normally be set 30-75 days after the case is filed leaving you very little time to request the waiver of your court fees. If you don’t ask for a waiver of your court fees at the time you file your small claims case either because you forgot or because your financial circumstances changed, you may also be able to ask for a fee waiver if you can't afford fees later in your case.

Learn more about filing a California small claims lawsuit.

Do You Qualify For a Waiver?

You may be able to have your California small claims court fees waived, if you qualify for 1 of the following options:

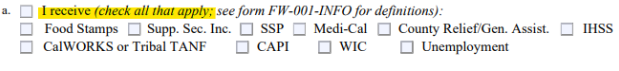

a. You receive public benefits like (Food Stamps (CalFresh), Supp. Sec. Inc., SSP, Medi-Cal, County Relief/Gen. Assist., Cal-Work, General Assistance, IHSS, CalWorks or Tribal TANF, CAPI, WIC, Unemployment,

b. Your household’s monthly income falls below a certain amount (more on this below), or

c. You do not have enough income to pay for your household’s basic needs and your court fees. Small claims court fees are between $30-$75 (if you qualify for a waiver of your court fees you are also able to have the sheriff waive serving fees of $40 per person or business you sue).

The instructions below will help you complete the application for waiver of court fees and costs and better assess which of the three options to choose from.

Keep in mind that ultimately, a judge will be reviewing the FW-001 Waiver, and decide whether to accept or reject your request to waive court fees. The judge’s decision will be listed on another form called FW-003 Order on Court Fee Waiver.

What We Have Learned at People Clerk about California Small Claims Court Fee Waivers

People Clerk is a public benefit corporation on a mission to make the legal system affordable and accessible to all. While we charge for our service, we provide an additional service included in our price to our clients that would like to apply for a waiver of their court fees.

Here are some brief thoughts on what we have learned so far about California fee waivers:

Judges that review FW-001 Waivers take a subjective and not objective approach to approving or rejecting fee waiver requests. This means that judges don’t follow a formula for evaluating fee waiver requests.

It is rare for a judge to reject a fee waiver request based on public benefits received (option 5(a)).

We have seen judges reject a fee waiver request based on a household’s monthly income(option 5(b)) because they would like to see additional proof of income received per month (not a requirement on the form), they would like the applicant to complete the right-hand side of page 2 (not a requirement on the form), and they doubted how someone paid for their food or phone bill if they didn’t receive any income.

We have seen judges often and inconsistently reject fee waivers based on someone certifying that they don’t have enough income to pay for their household’s basic needs and court fees (option 5(c)).

We will continue to learn from our findings and give a voice to individuals that are not represented by attorneys. We invite the California legislature to decide that an objective standard should be taken when approving or denying fee waivers as it should not be left up to judicial discretion.

Step by Step Instructions on How to Fill Out #1-#4 of the FW-001 Waiver Form

Things to keep in mind:

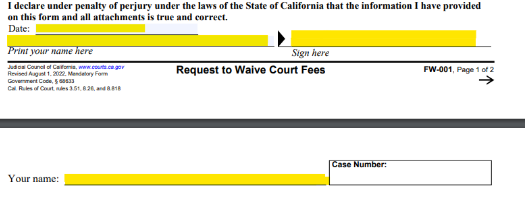

Make sure you are completely honest when completing this form as it will be reviewed by a judge. By signing this form, you are certifying “under penalty of perjury” that the information you have provided is true.

The form asks intrusive financial questions but it is confidential and won’t be publicly accessible to people outside of the court.

Need California small claims assistance? People Clerk can help.

1. Fill out your basic information under #1 and #2.

You don’t need to list any information under #2 if you don’t have a job.

2. Only fill out #3 if you have a lawyer helping you with your small claims lawsuit.

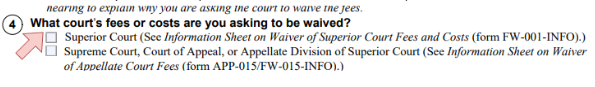

3. Under #4 check Superior Court (this is the court for small claims).

Instructions on How to Fill Out #5 of the FW-001 Waiver Form:

Under #5 you will see three options: 5(a), 5(b), or 5(c). You can only choose one of these options. Check the box next to either 5(a), 5(b), or 5(c).

What To Do if You Choose Option #5(a):

1. Select option #5(a) if you receive public benefits, such as:

Food Stamps (CalFresh)

Supp. Sec. Inc.

SSP

Medi-Cal

County Relief/Gen. Assist.

Cal-Works

General Assistance

IHSS

CalWorks or Tribal TANF

CAPI

WIC

Unemployment

2. You may check all the public benefits that apply.

What To Do if You Choose Option #5(b):

1. If your household income is less than one of the set amounts listed below, you will need to fill out information about your household income. You may need to look at paystubs or other documents with your income (and anyone else who lives with you) to fill out this information.

2. Select option #5(b) if your household income before taxes is less than the following amounts:

$2,265.00 for a family of 1

$3,051.67 for a family of 2

$3,838.34 for a family of 3

$4,625.00 for a family of 4

$5,411.67 for a family of 5

$6,198.34 for a family of 6

If more than 6 people at home, add $786.67 for each extra person.

If you choose option #5b you must also fill out #7,#8, and #9 on page 2 of the FW-001 Waiver form.

3. Question 7 asks if your income changes a lot from month to month. If it does, check the box and answer Questions 8 and 9 based on your average monthly income for the last 12 months. If your income does not change a lot from month to month, don’t check the box for Question 7.

4. Question 8 (Your Gross Monthly Income) asks you to write down the source of any income you receive each month.

For example, if you receive $1,000 of social security income, you will write next to the number (1) “social security” and next to the money sign $ “1,000”.

You will then add the total income you receive in a month and enter the amount where it states “b. Your total monthly income:” If you don’t receive any money each month, you will list a “0” next to your total monthly income.

5. Question 9 (Household Income) asks you about people who you live with that either depend on you for support or who you depend on for support.

For example, if you have elderly parents that depend on you for support, you will list them here. Another example is that you have children that depend on you for support, you will list them here.

For each one of these people that live with you, make sure to list their name, age, their relationship to you, and their monthly income (before any deductions).

What To Do if You Choose Option #5(c)

1. If you can't afford the court fees ($30-$75) and your household's basic needs you will need to fill out the information about your income and expenses on page two of the FW-001 Waiver Form. You may need to look at things like paystubs, bills, and bank statements, to fill out this information. Keep in mind you need to complete all the questions on page 2.

2. Follow the steps listed in the section above for Questions 7, 8, and 9.

3. Question 10 (Your Money and Property) has you list how much cash you have, how much money you have in your bank accounts, and any assets you have. If you don’t have any cash, list “$0” in that section.

4. Question 11 (Your Monthly Deductions and Expenses) has you list payroll deductions and what you spend money on each month (rent, food, etc.). Don’t forget to add your monthly expenses and list the total amount where it states “total monthly expenses (add 11a-11n above)”.

5. You will need to fill out everything (#7, #8, # 9,#10, and #11) on page 2 of the FW-001 Waiver form.

We do not recommend fee waiver option #5(c) because it is arbitrary (decided on a case-by-case basis) and, more often than not, courts reject a fee waiver request if it is based on option #5(c).

Review Your Completed Fee Waiver and Sign

1. Don’t forget to sign and print your name on the highlighted areas on the FW-001 Waiver form. Also, fill out the date you are signing on.

2. You don’t need to list your case number if you are filing the form at the same time as your small claims lawsuit.

3. Make sure you review the form in detail. If you don’t complete a section that should have been completed, the court clerk may reject and the small claims process will delay.

What To Do After You Have Filled Out the FW-001 Waiver Form:

1. Fill out #1, #2, and #3 on the FW-003 Form. The court will use the FW-003 Form to write down their decision about your fee waiver.

2. Make a copy of your completed FW-001 Waiver Form.

3. File your FW-001 Waiver and FW-003 Forms with the court clerk.

Take the original and a copy of the FW-001 Waiver Form to the court clerk. Also, take the FW-003 Form (you do not need to make a copy of the FW-003 Form).

You can file your forms by mail. You need to include a self-addressed stamped envelope so the clerk can mail your copies back to you. If you do not include a self-addressed stamped envelope you will have to go to the courthouse to pick up your copies.

Your court may also allow online filing. Check on the court’s website or call the court to find out if they allow online filing.

After you Submit a Court Fee Waiver

1. Keep an eye out for any mail from the court. You will find out about the court’s decision on your request to waive your small claims fees in the mail.

2. Once you receive the FW-003 Form, review it in detail to confirm that the court approved your request to waive your court fees. If the court rejected your request to waive your court fees the FW-003 form will let you know why.

3. If your financial situation changes after the court approves your request to waive court fees, you must notify the court using form FW-010.

As a reminder, if you need California small claims assistance, People Clerk is here to help.

Camila Lopez

Legal Educator at JusticeDirect. Camila holds a law degree and is a certified mediator. Her passion is breaking down complicated legal processes so that people without an attorney can get justice.