People Clerk helps you with your small claims court lawsuit.

Get StartedContents

Is a bank, lender or some other financial company treating you unfairly? You have several options including submitting a complaint to the Consumer Financial Protection Bureau. If a financial institution has wronged you, then submitting a complaint may be your next step.

This article outlines the following ways to resolve your dispute against a financial company:

File a complaint with the Consumer Financial Protection Bureau

File a complaint with the Better Business Bureau ("BBB")

File a small claims court lawsuit

Consumer Financial Protection Bureau

What is the Consumer Financial Protection Bureau?

The Consumer Financial Protection Bureau is U.S. government agency that sets and enforces rules that ensure that banks, lenders, and other financial companies are properly treating their consumers.

What types of complaints does the Consumer Financial Protection Bureau handle?

The Consumer Financial Protection Bureau handles a broad range of complaints against financial companies. Here are some of the most common examples:

Money Transfers: You transferred money but it never was delivered or you transferred money to the wrong person and can't get it back.

Bank account or service: Problems with your bank account and accessing the money in your bank account.

Depositing or withdrawing money: You had a problem at the ATM where the correct amount was not deposited or the correct amount was not withdrawn.

Credit reporting: Incorrect information on your credit report.

Security breach: Failure to provide account security against scammers.

Debt collection: Sent to collections for a debt you don't owe.

Credit card: Billing disputes with your credit card company.

Student Loans. Sent to collections for student loan payments that you don't owe.

If you think a financial company has acted wrongfully against you, the Consumer Financial Protection Bureau may investigate them on your behalf.

Consumer Educational Tools from the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau has published guides on common questions relating to problems with financial companies and what your rights are. Here are some quick links:

How to File a Complaint with the Consumer Financial Protection Bureau

Online: Consumer Financial Protection Bureau Complaint portal

You can also contact their consumer hotline for more information: (855) 411-2372

The Consumer Financial Protection Bureau will conduct an investigation of your complaint against the financial institution. They will review any supporting evidence you choose to upload and they will reach out to the company for a response. Make sure you create an account on the Consumer Financial Protection Bureau's website so you can follow the status of your complaint!

What happens if your Consumer Financial Protection Bureau complaint isn't resolved? You may want to try suing in a California small claims court or filing a complaint with the BBB.

The Better Business Bureau (BBB) and Complaints Against a Financial Institution

What is the BBB?

The BBB is a non-profit that serves as an intermediary between companies and consumers.

Reasons Why Some Financial Companies Respond to BBB Complaints

If the financial company is accredited with the BBB and they don't respond to a BBB complaint, their accreditation may be revoked and the complaint becomes part of their BBB profile.

If the financial company is not accredited with the BBB, the complaint will become part of their BBB profile.

BBB reviews provide other consumers with confidence when engaging with a financial company. Financial companies do not want negative BBB complaints.

What types of complaints against financial companies does the BBB handle?

The BBB handles a broad range of complaints against financial companies. Here are some examples:

If your financial company falsely advertises a promotion.

If your financial company fails to refund you or credit you money owed.

If your financial company does not fulfill a term to their contract.

The financial company is charging you for a service you did not sign up for.

Read More: How to file a complaint with the Better Business Bureau (BBB)

How to file a complaint against a financial company with the BBB

Scroll to the bottom of the page and click the button “Start Your Complaint.”

What to Expect Once you Submit your Complaint to the BBB

The BBB will forward your complaint to the financial company within 2 business days.

The financial company will be asked to respond within 14 days, and if a response is not received, a second request will be made.

You will be notified of the financial company’s response when the BBB receives it (or notified that they received no response).

Complaints against financial companies are usually closed within 30 business days.

What to do if no agreement is reached after a BBB complaint? You may want to try suing in a California small claims court

California Small Claims Court

Suing a financial company is a very common type of small claims lawsuit. Make sure to review your financial company's terms and conditions for any requirements prior to filing a lawsuit.

What types of lawsuits can be filed against a financial company in small claims?

Many types of lawsuits can be filed against a financial company, the most common ones are over:

You transferred money but it never was delivered or you transferred money to the wrong person and can't get it back.

Problems accessing money in your bank account.

Problem with a promotion they advertised but didn't give you.

You were not refunded after they promised to refund you.

Problem when you deposited or withdrew money at the bank.

Sent to collections for a debt you don't owe.

Incorrect or false information on your credit report.

Billing disputes with your credit card company.

Make sure to review the Consumer Financial Protection Bureau guides listed above, run a google search to research the law, or contact a lawyer if you want to determine your chances of winning your lawsuit.

Small Claims Court Limits

To be able to file a small claims court lawsuit in California, you are capped at the amount you can sue for, also known as "small claims court limits."

If you are owed for more than the amount you can sue for, you can still sue for the maximum amount allowed, but you will need to waive any additional amount over the limit.

What are the California Small Claims Court Filing Fees?

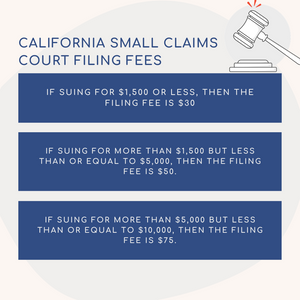

The amount you will pay to file a small claims lawsuit in California depends on how much you are suing for. You will pay between $30 to $75 to file the lawsuit. If cannot afford to pay court fees, you can ask the court to waive the fees.

What are other costs for Small Claims Court?

In most small claims cases, you can expect to pay:

Filing fees (see above) $30- $75

Serving Costs can range from $0-$75 per person you sue.

If you win, you can request that the losing party pay for your court fees and serving costs.

Frequently Asked Questions

Do I need a lawyer to go to court? No, in fact, California does not allow lawyers to represent you at the initial small claims hearing.

What are small claims hearings like in California? The hearings are quick and on average are 10-15 minutes. Learn more here.

How long does small claims take? A court usually schedules the small claims hearing no later than 70 days from when the lawsuit is filed. Learn more here.

Camila Lopez

Legal Educator at JusticeDirect. Camila holds a law degree and is a certified mediator. Her passion is breaking down complicated legal processes so that people without an attorney can get justice.